Financial literacy is an essential skill that lays the groundwork for a child’s future economic well-being. In an increasingly complex financial landscape, understanding how money works is crucial for making informed decisions. Children who grasp the basics of financial literacy are better equipped to manage their finances as they grow older, leading to healthier financial habits and reduced stress related to money management.

The earlier children learn about financial concepts such as saving, spending, and investing, the more likely they are to develop a positive relationship with money. Moreover, financial literacy fosters critical thinking and decision-making skills. When children learn to budget their allowance or save for a desired toy, they engage in problem-solving and planning.

These skills extend beyond finances; they can be applied in various aspects of life, from academic pursuits to personal relationships. By instilling financial literacy at a young age, parents can empower their children to navigate the complexities of adulthood with confidence and competence.

Key Takeaways

- Financial literacy for kids is important for their future financial well-being and independence.

- The Child Finance Tracker is a tool designed to help kids understand and manage their money.

- Teaching kids the value of money and budgeting early on can set them up for financial success later in life.

- Setting financial goals with your kids using the Child Finance Tracker can teach them the importance of saving and planning for the future.

- The Child Finance Tracker can help kids track their allowance, chores, and savings, promoting financial responsibility and independence.

Introducing the Child Finance Tracker: What It Is and How It Works

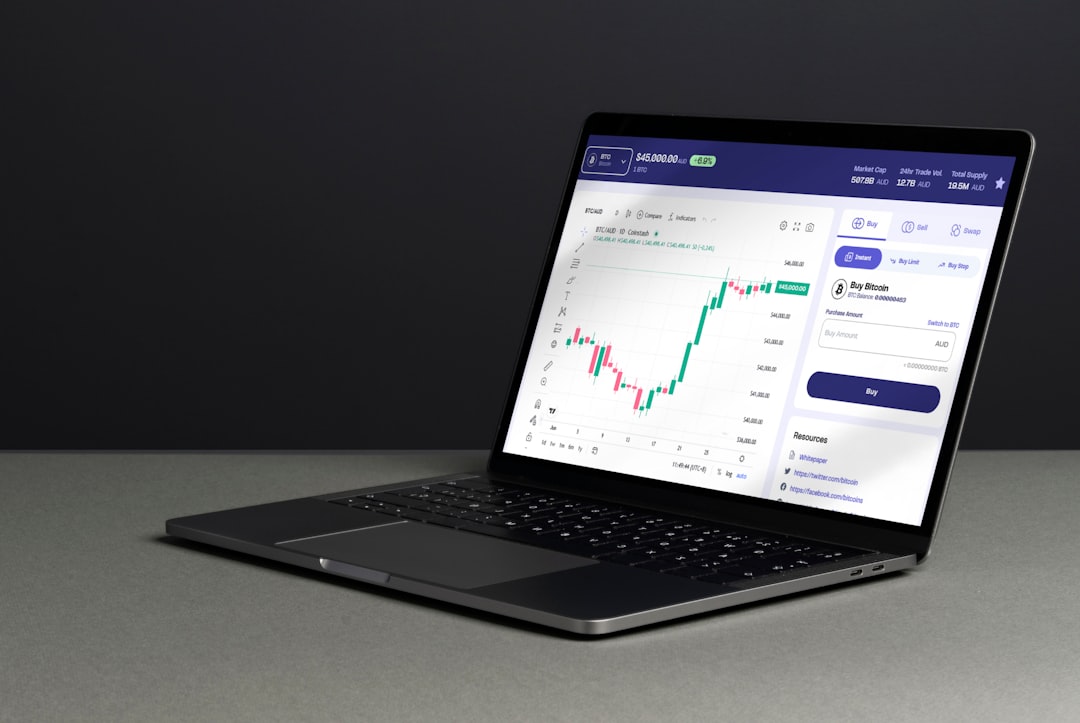

The Child Finance Tracker is an innovative tool designed to help children understand and manage their finances effectively. This digital or physical platform allows kids to track their income, expenses, savings, and financial goals in a user-friendly manner. By providing a structured way to visualize their financial activities, the Child Finance Tracker makes learning about money engaging and interactive.

It often includes features such as charts, graphs, and gamified elements that appeal to children’s natural curiosity and desire for play. The functionality of the Child Finance Tracker is straightforward yet comprehensive. Children can input their allowance, earnings from chores, or gifts received, and categorize their spending on items like toys or snacks.

The tracker may also allow them to set savings goals for larger purchases, helping them understand the concept of delayed gratification. By regularly updating their tracker, kids can see their progress over time, reinforcing the importance of budgeting and saving. This hands-on approach not only makes financial concepts tangible but also encourages children to take ownership of their financial decisions.

Teaching Kids the Value of Money and Budgeting with the Child Finance Tracker

Using the Child Finance Tracker provides an excellent opportunity to teach kids about the value of money. Children often perceive money as an abstract concept; they may not fully understand where it comes from or how it can be spent wisely. By engaging with the tracker, kids can learn that money is earned through work—whether it’s completing chores or receiving an allowance—and that it must be managed carefully to meet their needs and wants.

Budgeting is a fundamental aspect of financial literacy that can be effectively taught through the Child Finance Tracker. Parents can guide their children in creating a simple budget by allocating portions of their income to different categories: spending, saving, and sharing (charity). For instance, if a child receives $10 as an allowance, they might decide to spend $4 on a toy, save $5 for a future purchase, and donate $1 to a local charity.

This exercise not only teaches budgeting but also instills values such as generosity and foresight. As children see how their choices impact their financial situation in real-time through the tracker, they develop a deeper understanding of responsible money management.

Setting Financial Goals with Your Kids Using the Child Finance Tracker

| Financial Goals | Child Finance Tracker Metrics |

|---|---|

| Saving for college | Amount saved per month |

| Teaching budgeting | Spending habits tracking |

| Setting up an allowance | Allowance distribution frequency |

| Investing for the future | Investment portfolio growth |

Setting financial goals is a critical component of financial literacy that can be seamlessly integrated into the Child Finance Tracker experience. Children often have aspirations—whether it’s buying a new video game or saving for a bicycle—and learning how to set and achieve these goals is invaluable. The tracker allows kids to define specific goals, determine how much they need to save, and create a timeline for achieving these objectives.

This process teaches them about planning and perseverance. For example, if a child wants to buy a new skateboard costing $50, they can use the tracker to break down how much they need to save each week from their allowance or earnings from chores. By visualizing their progress through graphs or charts within the tracker, children can see how close they are to reaching their goal.

This not only motivates them but also reinforces the idea that financial goals require commitment and discipline. As they experience the satisfaction of achieving these goals, they learn that patience and planning are essential components of financial success.

Tracking Allowance, Chores, and Savings with the Child Finance Tracker

The Child Finance Tracker serves as an effective tool for monitoring various aspects of a child’s financial life, including allowance management, chore earnings, and savings accumulation. By keeping track of these elements in one place, children gain a comprehensive view of their financial situation. This holistic approach helps them understand how different sources of income contribute to their overall financial health.

When children receive an allowance or earn money through chores, they can log these amounts into the tracker immediately. This practice not only reinforces accountability but also helps them recognize the value of hard work. For instance, if a child earns $5 for completing chores each week, they can see how this income adds up over time when combined with their allowance.

Additionally, tracking savings becomes more engaging when children can visualize their progress toward specific goals. The ability to see their savings grow encourages them to continue saving rather than spending impulsively.

Encouraging Responsibility and Independence in Kids with the Child Finance Tracker

One of the most significant benefits of using the Child Finance Tracker is its ability to foster responsibility and independence in children regarding their finances. As kids take charge of tracking their income and expenses, they learn valuable lessons about accountability. They begin to understand that managing money is not just about having it but also about making informed choices about how to use it wisely.

By allowing children to manage their finances through the tracker, parents encourage them to make decisions independently. For example, if a child has saved enough money for a desired toy but also has other expenses looming—like school supplies—they must weigh their options carefully. This decision-making process cultivates critical thinking skills and helps children understand the consequences of their choices.

Over time, as they become more adept at managing their finances independently, they build confidence in their ability to handle money responsibly.

Tips for Using the Child Finance Tracker Effectively with Your Kids

To maximize the benefits of the Child Finance Tracker, parents should consider several strategies for effective use. First and foremost, consistency is key. Regularly updating the tracker together with your child reinforces its importance and keeps them engaged in the process.

Setting aside time each week for this activity can create a routine that emphasizes financial responsibility. Another effective tip is to make the experience enjoyable by incorporating gamification elements into tracking activities. For instance, parents can create challenges or rewards for reaching savings milestones or sticking to a budget for a month.

This approach not only makes learning about finances fun but also motivates children to stay committed to their financial goals. Additionally, discussing real-life financial scenarios—such as planning for family outings or budgeting for groceries—can help contextualize what they learn through the tracker.

The Long-Term Benefits of Teaching Kids Financial Management Skills

Teaching kids financial management skills through tools like the Child Finance Tracker has far-reaching implications that extend well into adulthood. Children who develop strong financial literacy skills are more likely to make sound financial decisions as adults, leading to greater economic stability and success. They are better equipped to handle credit responsibly, save for retirement early on, and avoid common pitfalls such as debt accumulation.

Furthermore, instilling these skills early on fosters a sense of confidence in managing personal finances. As adults, these individuals are likely to approach financial challenges with a proactive mindset rather than feeling overwhelmed or anxious about money matters. The ability to budget effectively, set realistic financial goals, and make informed investment choices contributes significantly to long-term wealth accumulation and overall quality of life.

Ultimately, teaching kids about financial management not only prepares them for personal success but also equips them with skills that can positively impact their families and communities in the future.